Ali Rizvi

Article Managing Your SaaS Revenue Recognition: Where QuickBooks Falls Short

While QuickBooks is known for its user-friendliness and affordability, it’s not built to handle complex revenue recognition processes. SaaS companies that generate revenue from subscription contracts face added intricacy in revenue recognition, especially following the passing of ASC 606.

If you struggle to maintain compliance with GAAP deferred and earned revenue recognition, you aren’t alone. Countless SaaS businesses find themselves outgrowing QuickBooks because of the challenges in reporting accurate revenue, making it important to understand the pitfalls of the system and alternatives to effectively manage the needs of your SaaS business.

QuickBooks falls short in recognizing complete performance obligations and leveraging automation, which is why meeting the needs of your SaaS company is important.

Recognizing Revenue the Right Way

In QuickBooks revenue is only recorded once the invoice is sent with no regard to the timing of the payments. For example, if a customer pre-pays a 6-month subscription in June, [depending on the setup] QuickBooks will record the entire amount in June. This may not follow ASC 606 since the entire performance obligation is not met. Instead, your SaaS company should record 1/6 of the contract each month for the next 6 months.

Properly recognizing performance obligations is important not only to comply with complicated rules set out by regulations but also to give your business transparent insight into monthly financials. Bloomberg reports that SaaS businesses have historically delivered revenue growth exceeding 30%, but cash flow margins remain at negative 20%.

What About Digital Transformation?

Everyone talks about “automation” these days and the term itself has become watered down. Instead of thinking if automation of a process can help or not, think if it as digital transformation. Using the latest technologies to improve something desperately in need of improvement.

Most SaaS companies, large and small, find themselves manually processing revenue in spreadsheets. They often stick with status quo because it feels harder to switch to something else, so the cycle of inefficiency continues, until some breaking point forces a change.

Why This is Important for SaaS?

SaaS businesses will need separate documentation to adjust the revenue recorded based on which contractual obligations are completed. Although you can create an invoice line item for each obligation, some SaaS businesses choose to use alternative programs to bill customers. Additionally, determining how much of the contract price or which line items are satisfied can easily become overwhelming.

Hitting the wrong key, recognizing the wrong contractual obligation, or forgetting to enter an invoice can throw off your entire system, leading to more time being spent trying to correct the mistake. If the mistake goes undetected for long periods of time, your SaaS business may also be making decisions based on incorrect information.

Does It Meet the Needs For Your SaaS Company?

Meeting the needs of your SaaS company shouldn’t require you to make a trade-off between convenience, price, and functionality. Are you actually outgrowing QuickBooks or just the revenue reporting capabilities? These are two starkly different areas.

QuickBooks is designed to house your general ledger, not facilitate proper revenue recognition. Shortcomings in QuickBooks lead SaaS businesses to search for other, pricier alternatives when they might not need to make the full switch.

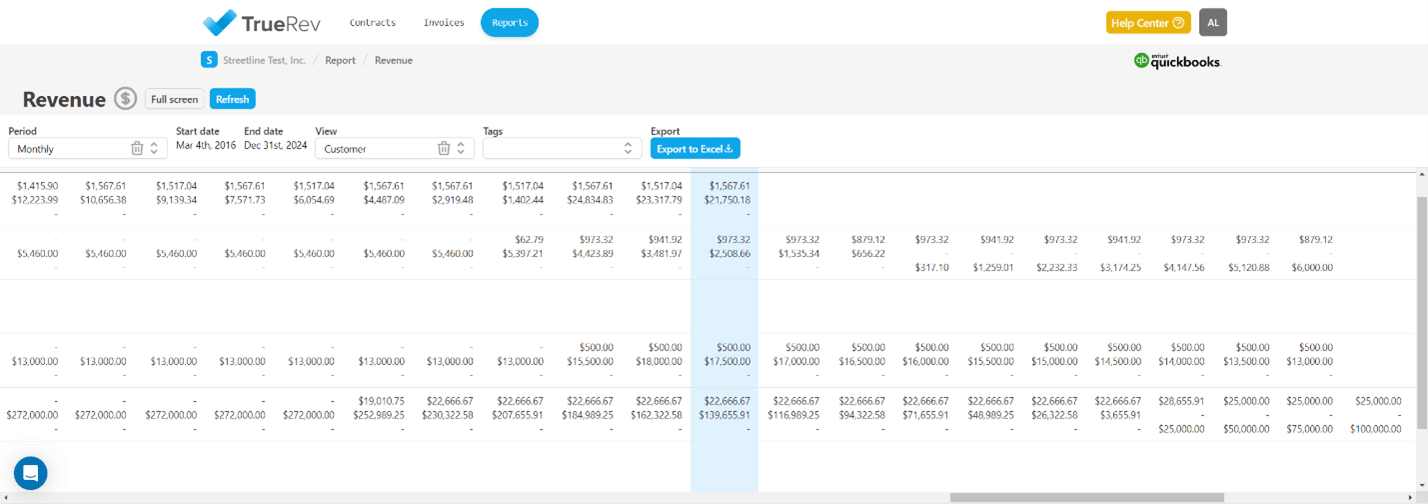

Instead, partnering with software that specializes in revenue recognition might be the answer to your problems. At TrueRev we provide continuous syncing of your books, up-to-date deferred and recognized revenue, and the tools to track bookings and collections.

The TrueRev platform syncs with QuickBooks, allowing you to enjoy automated and accurate revenue recognition without having to spend the time, and money, to switch to another accounting software. Contact TrueRev to learn more!

Want to see a demo?

we offer a 14-day free trial.