Join the companies embracing the future of financial operations

See how our customers are using TrueRev to save time, improve accuracy, and optimize understanding of their revenue.

Eliminated Spreadsheet Chaos and Unlocked Real-Time Financial Confidence

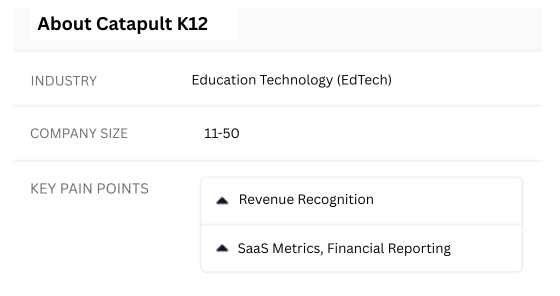

By integrating TrueRev with QuickBooks, Catapult K12 eliminated manual spreadsheets, reduced reporting time from days to minutes, and gained real-time visibility into key metrics like ARR and deferred revenue. The result—faster monthly closes, error-free reports, and renewed confidence in their financial data.

company: affordable, easy to use, and

powerful enough to provide actionable

insights without the cost or complexity of

enterprise-grade systems."

Scalability without Spreadsheets

When we onboarded TrueRev, we eliminated layers of manual effort. Contracts that took hours to review are now loaded and tracked in minutes. We stopped wasting time recalculating revenue every time a contract changed.

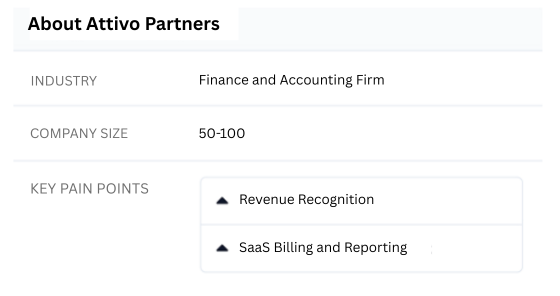

Saving money and eliminating errors

B2B clients’ complex revenue recognition means automation is a must, but the cost jump to expensive enterprise-level software is hard to justify. With TrueRev, ZenFinancials experts now easily provide automated revenue and real-time SaaS metrics for clients who use Quickbooks Online.

Easy setup and implementation

Rapid customer growth outstripped Glean.ai's ability to invoice customers manually. TrueRev now handles rev rec and deferred revenue journal entries and generates real-time SaaS metrics for the team and its investors.

Closing books in 2 days instead of 10

Maintaining revenue in excel spreadsheets was not only extremely time consuming but, also proving to be inaccurate. Managing deferred revenue properly in these sheets was almost impossible. TrueRev allows Intento to bucket revenues between Enterprise and SMB customers.

A simpler way to accurate revenue

Prior to switching to TrueRev, LineVision was utilizing a revenue recognition solution that was overly complicated (and expensive) for the company's needs. They also struggled with inaccurate historical data. After doing multiple demos with other companies, she settled on TrueRev because it was the easiest to use and the most affordable.

Multiple revenue streams

Perch has 3 consistent revenue streams - hardware sales, traditional SaaS subscriptions, and client services - that all need to be recognized on different cadences. Prior to TrueRev, the outsourced accounting firm was managing this process using Excel; Sumner often found discrepancies in rules.

Moving off spreadsheets

Previous founding experience taught Joe that the longer you keep doing revenue on spreadsheets, the harder it becomes to trust the accuracy of revenue and deferred revenue. In his opinion, you can’t really do "daily" rev rec in Excel. He logs into TrueRev every time they sign a new customer and every time somebody’s contract renews.

Want to see a demo?

we offer a 14-day free trial.