Paul Barnhurst

Article The Subscription Business Model and Revenue Recognition - A Working Guide with Examples!

This useful guide explains how a subscription business differs from a typical business and how this impacts revenue recognition. Guide covers:

- Subscription business model - What it is, what are the benefits, why it is different

- ASC 606 - The 5-Step process that guides how revenue is recognized

- Common revenue terms for subscription businesses (Bookings, Billings, Earned Revenue, Deferred Revenue, Unbilled Revenue)

- How to recognize revenue under different scenarios

- Annual vs. Quarterly vs. Monthly

- Bundled Products

- Upgrades

- Downgrades

- Cancellations

- Usage

Subscription Business Model

One of the fast-growing areas of the global economy is subscription businesses and the global pandemic only heightened this trend. A subscription-based model has many benefits for both the consumer and the business over traditional revenue models.

- Consumers often pay a monthly subscription fee for unlimited usage (Ex. Netflix)

- Consumers often get regular updates to the product in return for paying a monthly subscription (Ex. Microsoft)

- Consumers often get a discount for an annual Subscription (Ex. Grammarly, HubSpot, SalesForce)

- Subscription-based businesses often receive a valuation premium when being sold as they operate much like an annuity

- Subscription-based businesses often collect cash up front, which can help alleviate cash-flow challenges

- Subscription-based businesses can help with customer retention vs having to resell the product every time the customers uses it. Examples include the DVD rental model, or when you used to buy Microsoft Office in a box.

One of the things investors love best about a subscription business is it works a lot like a financial annuity. This annuity-like structure of subscription businesses is why investors pay a premium for subscription-based businesses.

In the insurance world, an annuity is a financial instrument that you pay for upfront and then receive annual payments over the life of the contract. For example say you pay 100,000 for an annuity that will pay you 5% for thirty years starting 20 years from today. In this case, it is very easy to calculate the cost and revenue you will earn

| Initial Annuity Payment | $100,000 |

| Annual Annuity Payouts | $5,000 |

| Years | 30 |

| Total Annuity Payouts | $150,000 |

From the above information one can easily calculate what rate of return the insurance company needs to earn on the $100,000 payment to ensure it makes its money back and it is easy for the holder of the annuity to understand how much revenue he will get every year for the life of the annuity. In the above example, the insurer would need to earn a rate of 2.85% on the 100,000 payment over the life of the payout to break even. Anything above a rate of 2.85% per year would result in a profit for the insurer. In the above example, this does not include any servicing or marketing costs only the annual payout costs.

A subscription business works similarly in that once a customer signs up you receive a certain amount of revenue for as long as the customer keeps the subscription. Retaining customers becomes vital to subscription businesses and measuring retention is important.

Let's take the example of a new fictional sports subscription service that provides TV coverage of the four major American Sports (NFL, NBA, MLB, and NHL) titled Sports Entertainment. The package known as the Ultimate Sports Package includes all televised games and costs $365 a year. Assume the average customer will keep the service for 30 years. The revenue for this service would be as follows:

| Annual Payments | $365 |

| Years | 30 |

| Total Payments | $10,950 |

An investor can then start to make projections of how much each customer will be worth based on the Gross and Net Profit you expect to earn from each customer over a lifetime and begin to come up with ways to value and pay for the company. As mentioned above, investors pay a premium for the subscription model due to the recurring nature of the revenue.

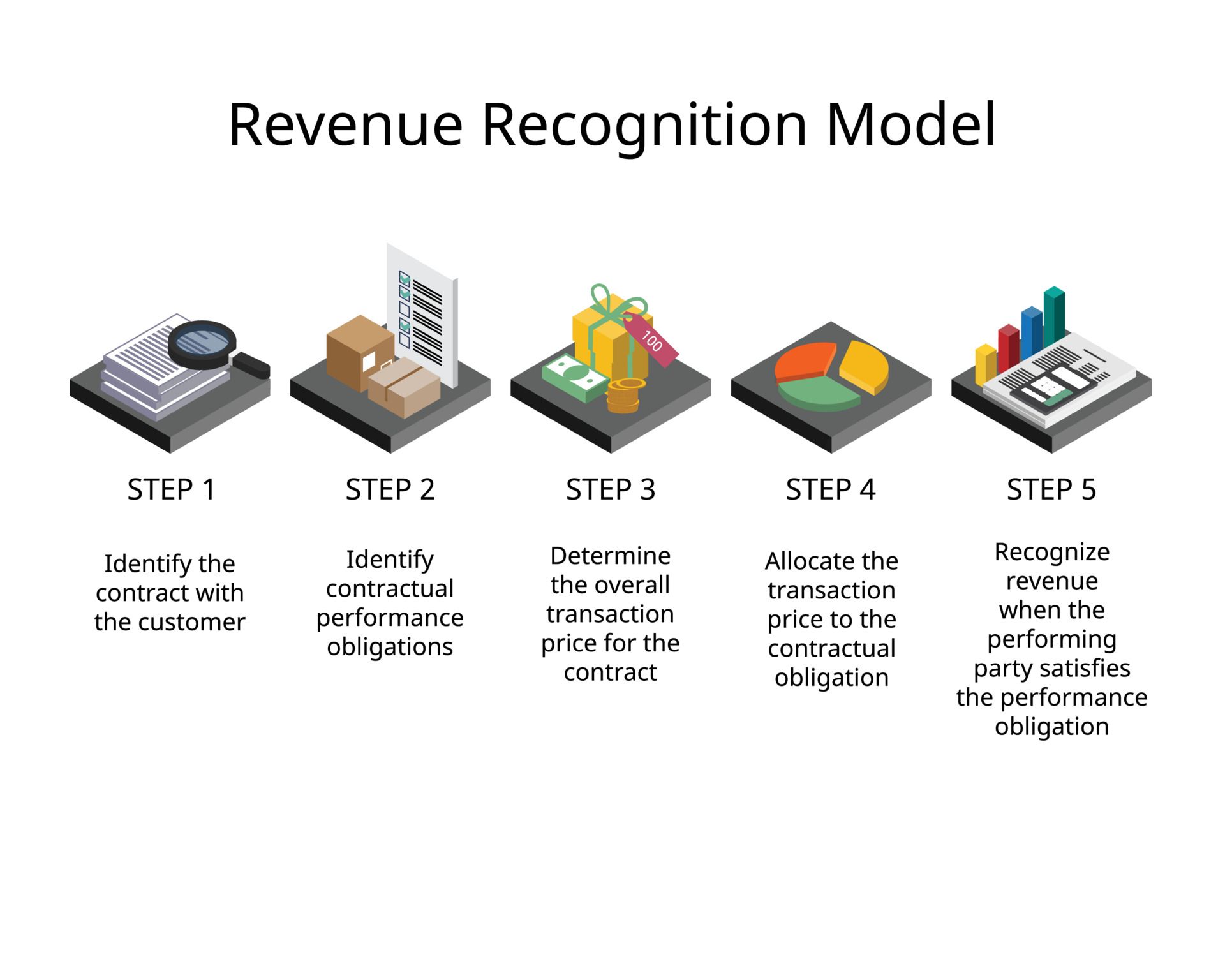

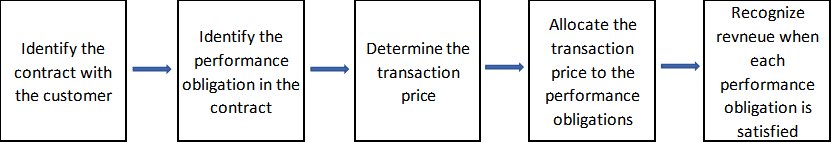

ASC 606 - Revenue Recognition

However the recurring nature of the revenue creates some challenges for companies when it comes time to recognize this revenue. Due to the issues with how businesses were recognizing this revenue the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) jointly created ASC 606 which provides a framework for recognizing SaaS and subscription-based revenue.

The 5-step framework is as follows:

Each company will use this framework to determine how to recognize revenue. In the above example let’s assume a customer goes to the website and orders a 1-year subscription using a credit card for $365 on January 1st, 2023.

- The contract occurred at the time the customer agreed to the terms and conditions by paying the annual subscription price of $365

- The performance obligation is one year starting on January 1st, 2023, and ending on December 31st, 2023

- The transaction price in this scenario is $365 which is the amount paid for an annual subscription

- Given the contract period is 365 days and we are calculating the rev rec daily we will allocate $1 of revenue to each day.

- At the end of each month we will recognize the revenue based on the number of days in the month. For January we would recognize $31 of revenue based on 31 days in the month

The above is an example of how the framework can be used to guide when revenue should be recognized. As you start to compound this example across 100’s and 100’s of customers it becomes very complex in a hurry and can be difficult to manage in Excel. In the next section, we will discuss the common terms and what each of them means when it comes to subscription billings.

Common SaaS Billing/Revenue Terms

Before we walk through different scenarios within subscription businesses let’s define the following common terms

Bookings - A sales booking is when an actual sale occurs and you record the sale for your records. A signed sales order from a customer is often considered a “booked deal, " and the date of signature indicates the period (eg Jan '23) when the booking happened.

Billings - A billing occurs when the customer is invoiced for the service being provided. In some cases this can be at the same time as the booking for the entire year and in other cases, the billing can occur at a later time after setup or even periodically. Billings in SaaS businesses can occur at different periods but the common billing cycles are annual, semi-annual, quarterly, and monthly.

Deferred Revenue/Unearned revenue - It is common for many SaaS businesses to bill the customer upfront for several months or a year at once. Under that scenario, the invoice or payment happened before the services were rendered, which is another way of saying the l revenue has not been earned. Accordingly, this revenue is considered “deferred” and is recorded in a deferred revenue account shown as a liability on the balance sheet.

Subscription Revenue - Subscription revenue is the revenue you recognize to your Profit and Loss statement P&L monthly. The revenue recognized is the revenue that has been earned during the month you are recognizing revenue and will often come from your deferred revenue schedule. Other than cash in the bank, revenue is your most important number and is fundamentally how investors gauge the strength of the business.

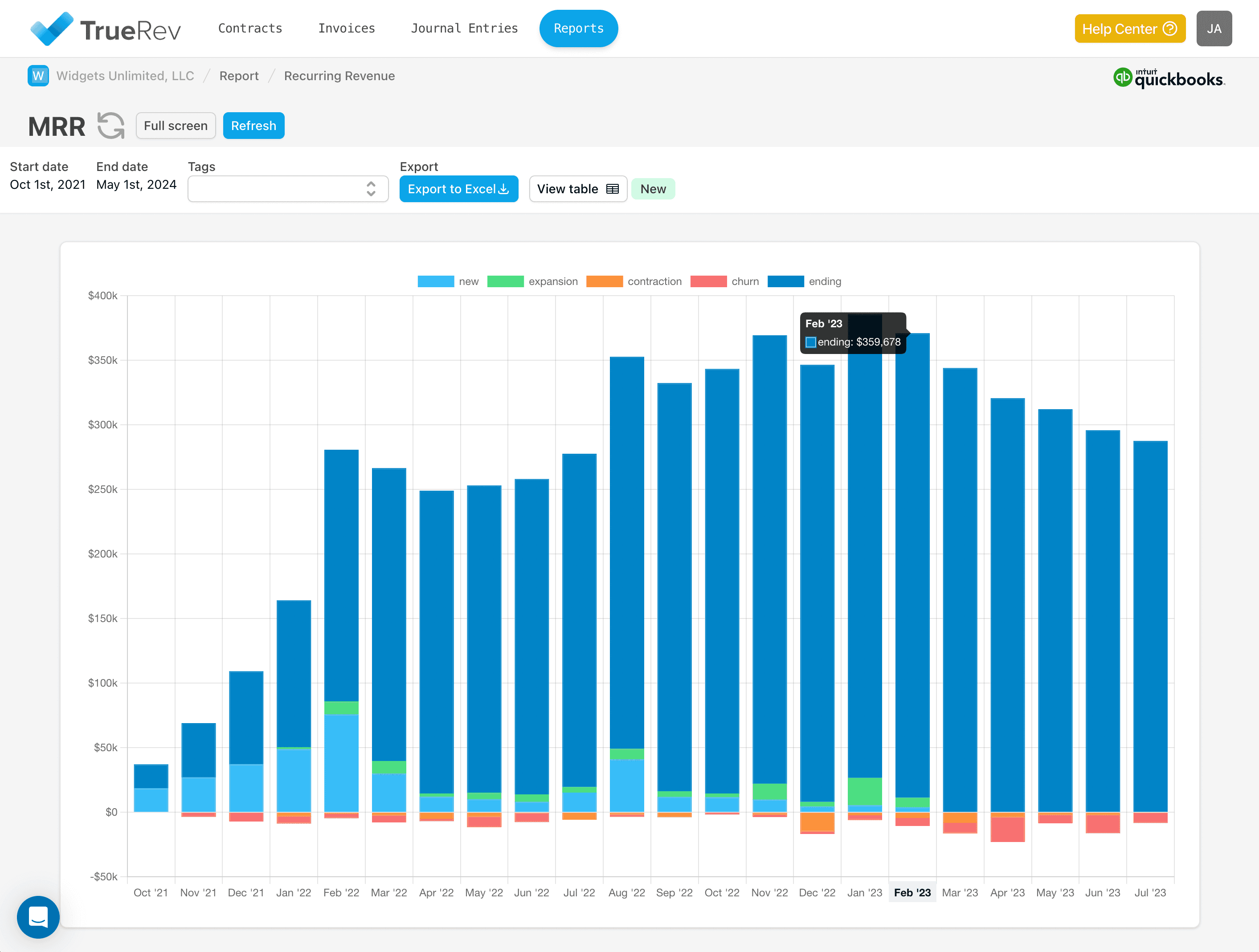

Many other terms are common as part of SaaS but one does not need to understand them to understand the revenue recognition process. Some of these terms include Annual Recurring Revenue (ARR), Average Revenue Per Unit (ARPU), and Monthly Recurring Revenue (MRR). With a better understanding of the terms let's walk through several examples of recognizing revenue. For the below examples, we will build on the sports subscription package we displayed earlier.

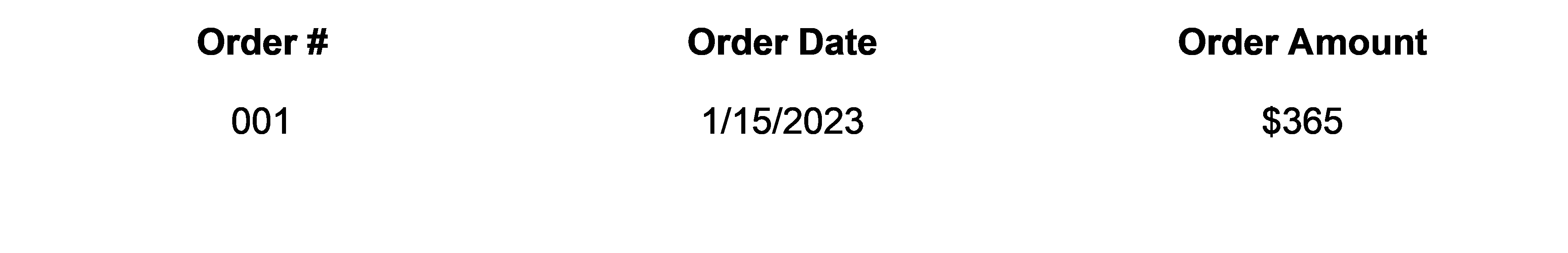

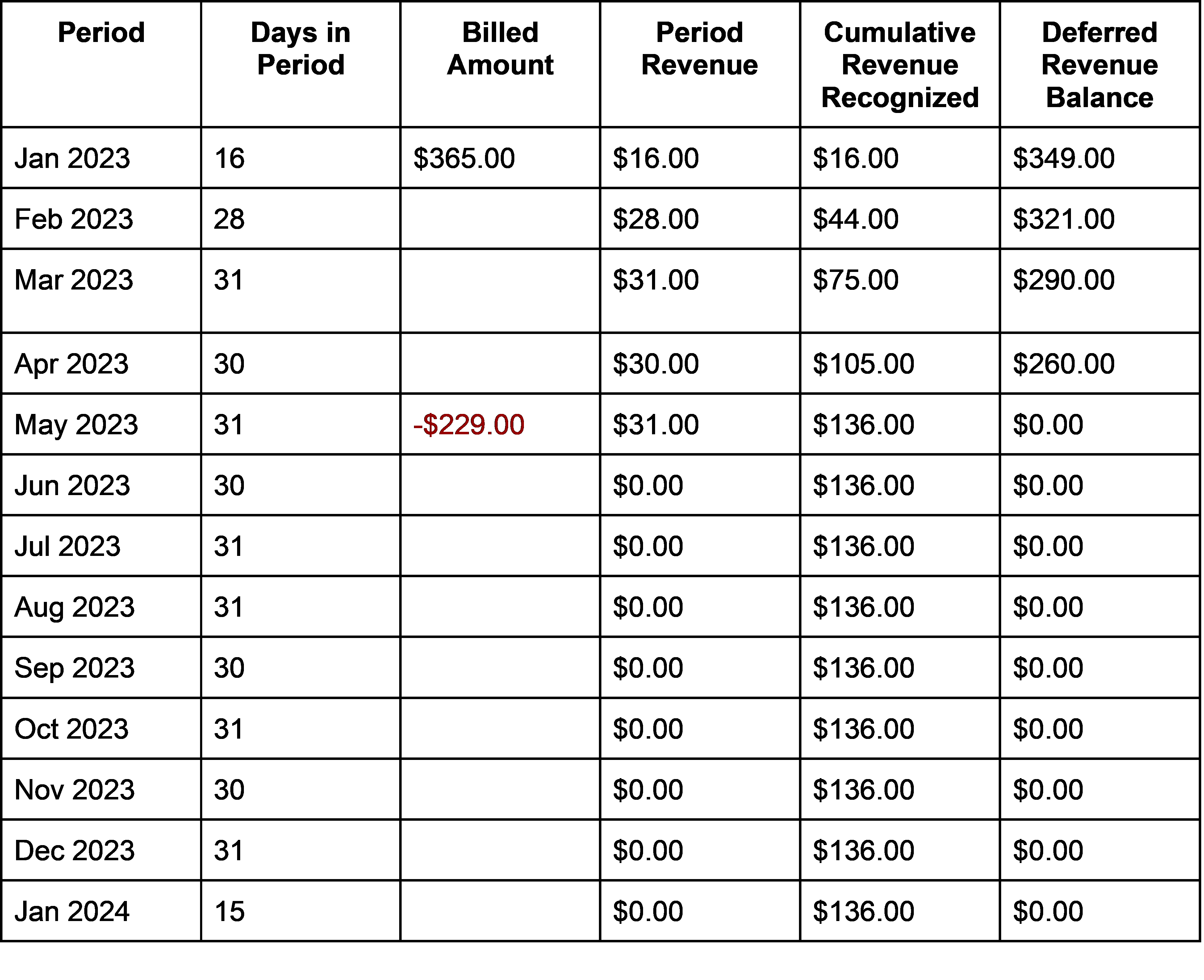

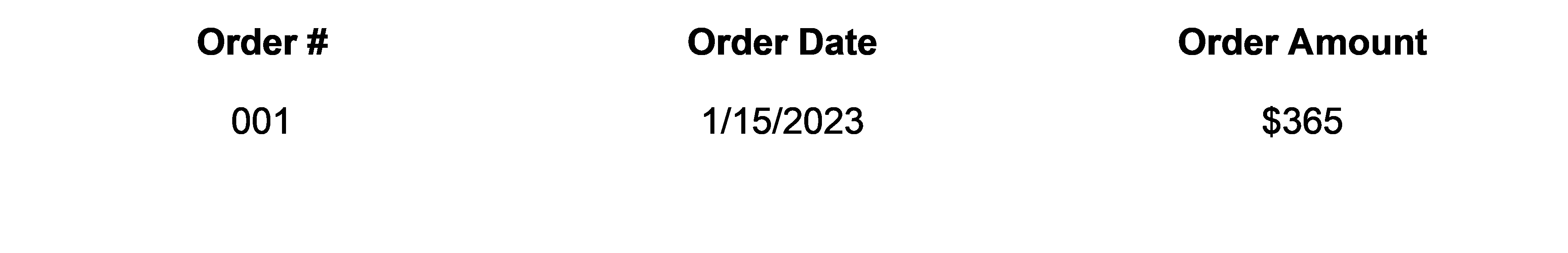

Annual Billing - Single Product

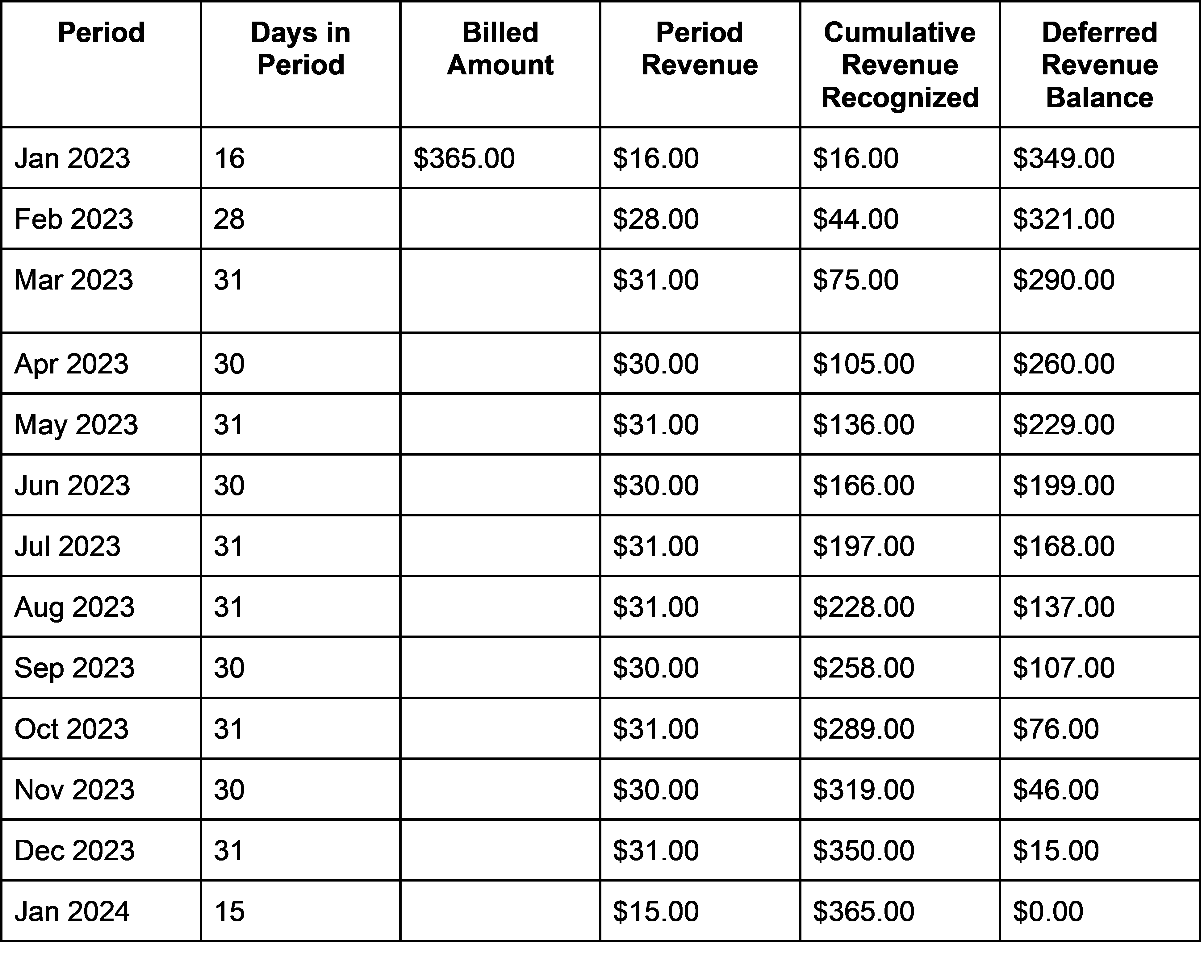

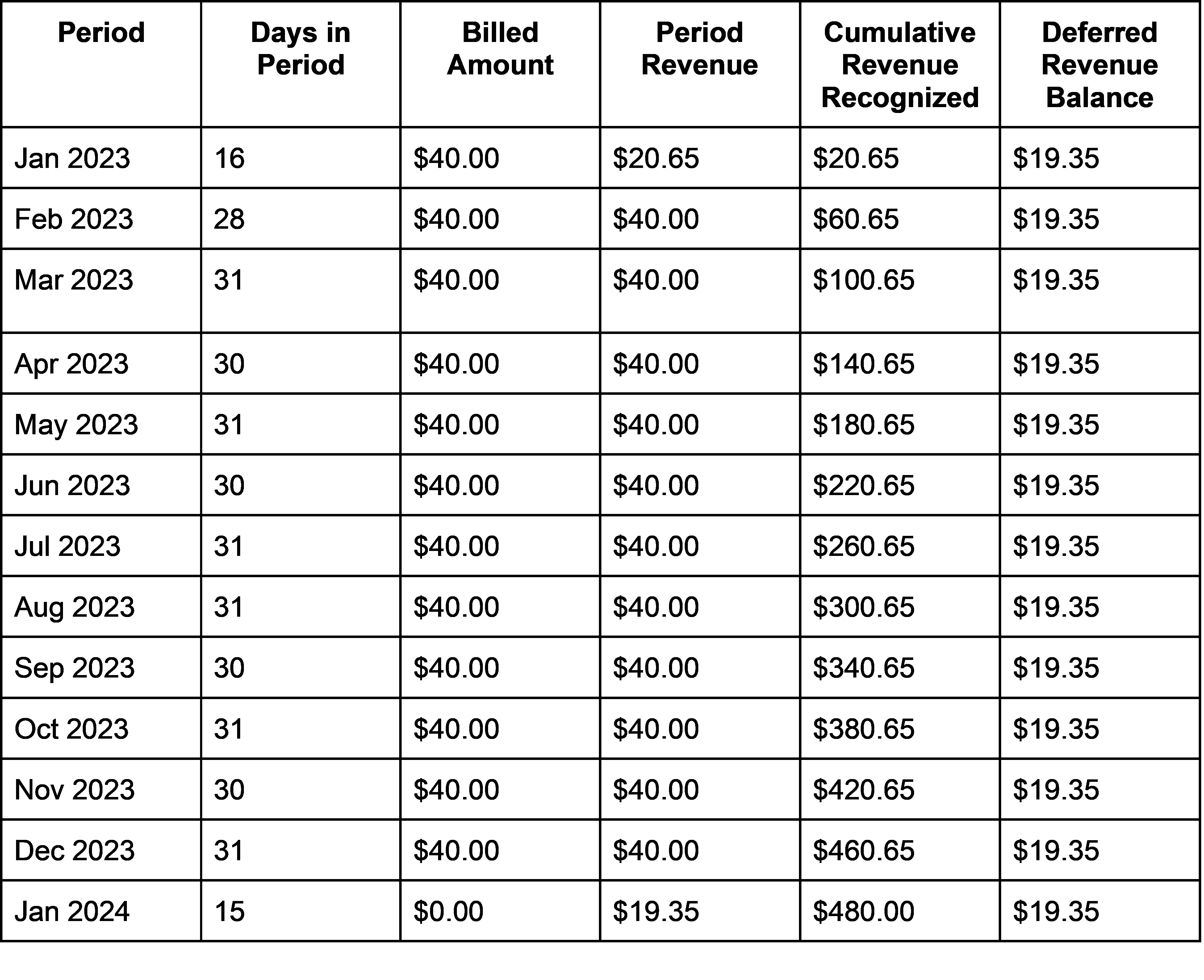

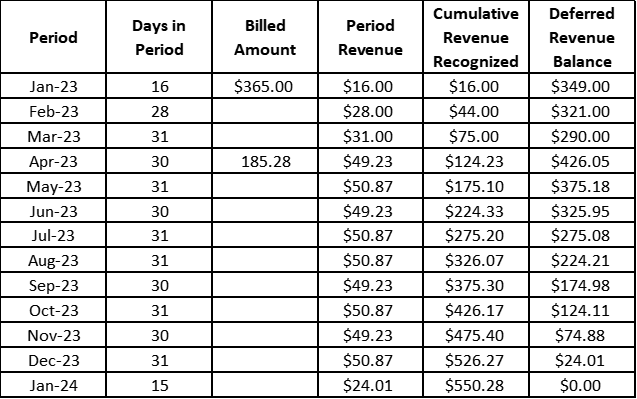

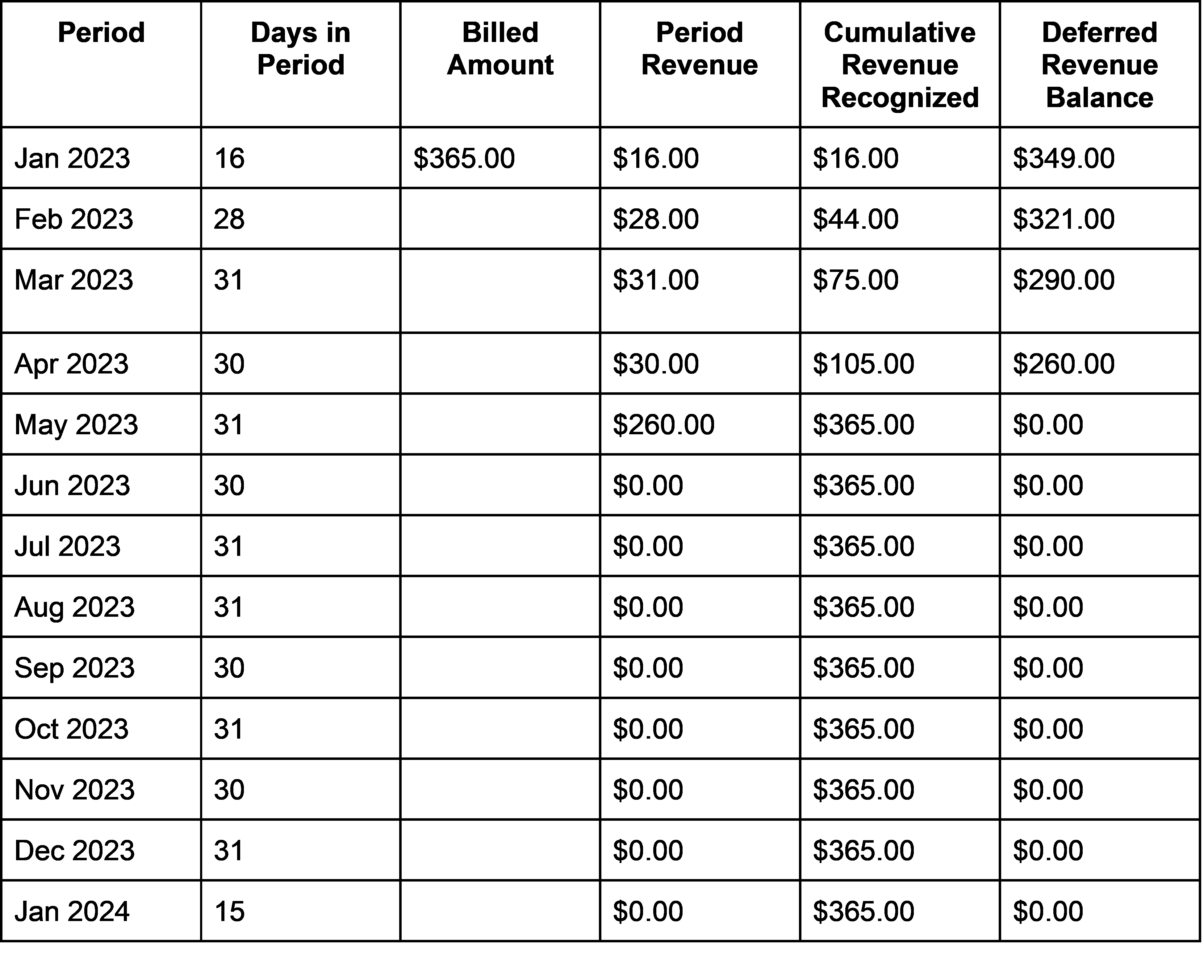

For this example let’s assume the customer signed up for the product on January 15th, 2023. and started receiving services the same day. At the time of customer sign up the customer was billed $365 for a one-year subscription through January 14th, 2024.

For this example the schedules would look as follows:

Revenue Schedule

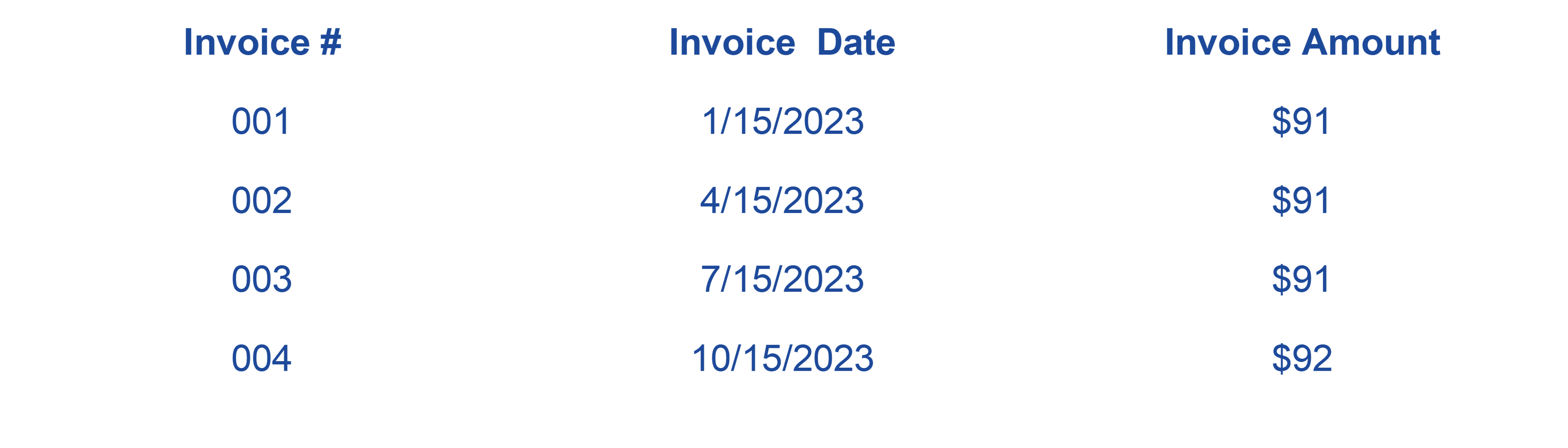

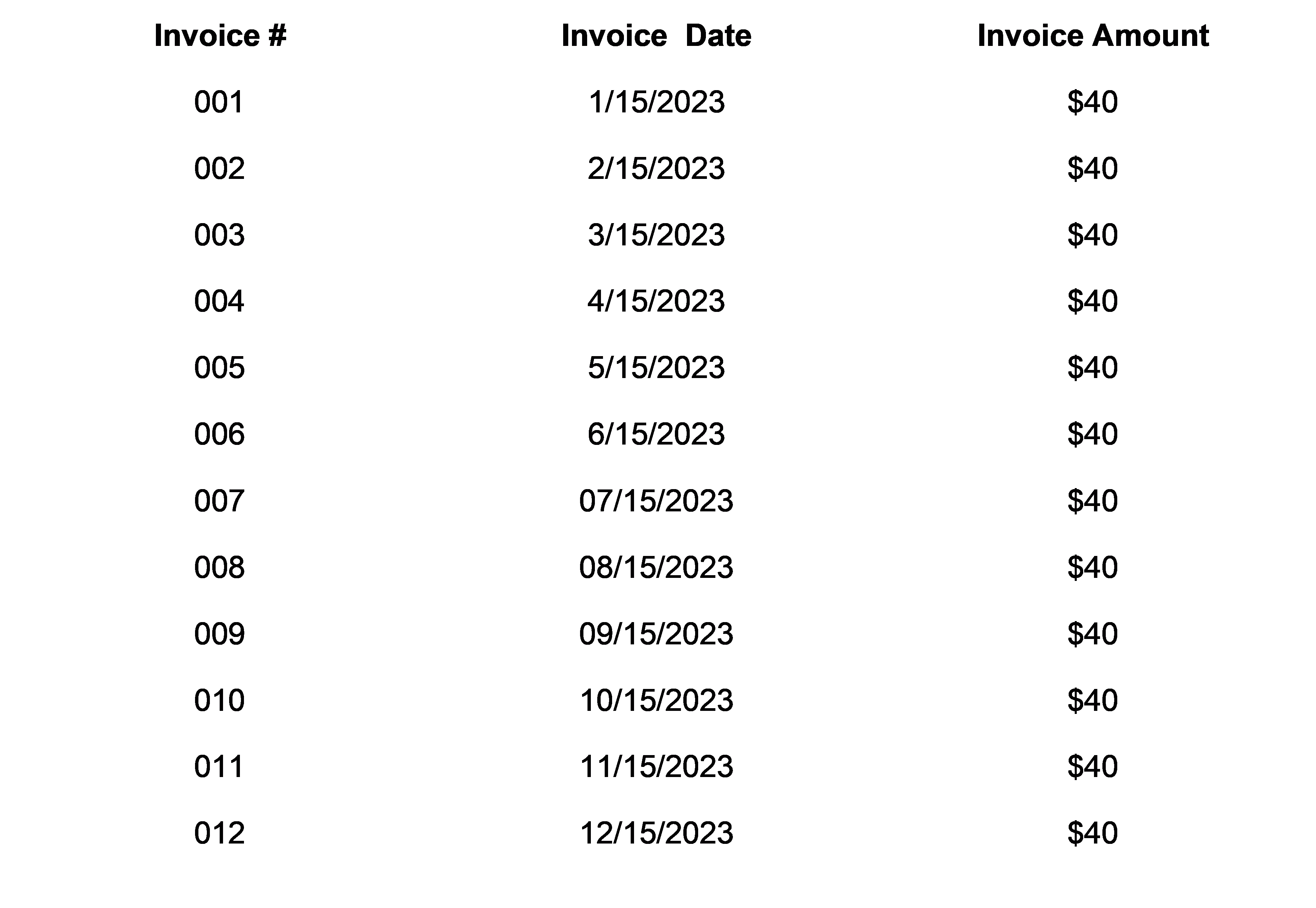

Quarterly Billing - Single Product

In this example we assume the customer signed up for the product on January 15th, 2023. and started receiving services the same day. At the time of customer sign up the customer was billed for one-quarter of the services and then will be billed every 3 months for the next 4 quarters and the one-year subscription will end on January 14th, 2023.

For this example the schedules would look as follows:

Revenue Schedule

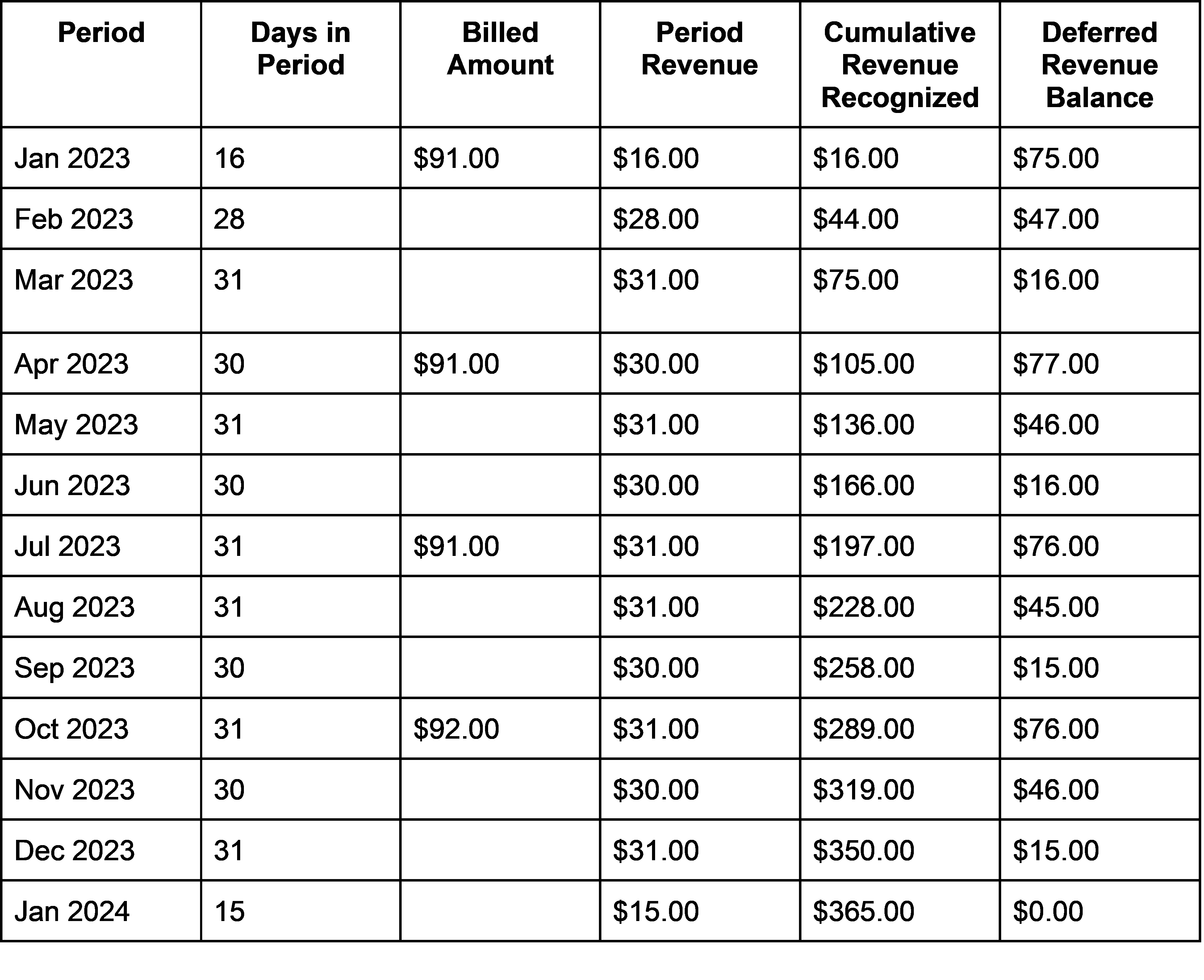

Monthly Billing - Single Product

In this example we assume the customer signed up for the product on January 15th, 2023. and started receiving services the same day. At the time of customer sign up the customer was billed for one full month of services and then will be billed every month for the services and the one-year subscription will end on January 14th, 2023. The customer will be billed $40 a month as no discount was given because the customer did not pay for the services in advance. Furthermore, in this example, we have chosen to recognize $40 per month and not use a daily deferred schedule as we did in the quarterly and annual examples. This is to keep it simple as the amount charged is the same each month so it makes sense to recognize the same amount of revenue in each month.

For this example the schedules would look as follows:

Revenue Schedule

Bundled Products

Our sports subscription service offers a number of add-on bundles that a customer can sign up for including:

- College Sports Package - $199.99 Annually

- Cricket Sports Package - $79.99 Annually

- Premier League Soccer Package - $69.99 Annually

- National Rugby League Package - $49.99 Annually

- Major League Soccer Package - $39.99 Annually

- Close Game Alerts Package - $19.99 Annually

- The Everything Package - $599 Annually

The 1st Add-on Bundle is at regular price and for each package after the 1st package ordered the customer receives a $5 discount.

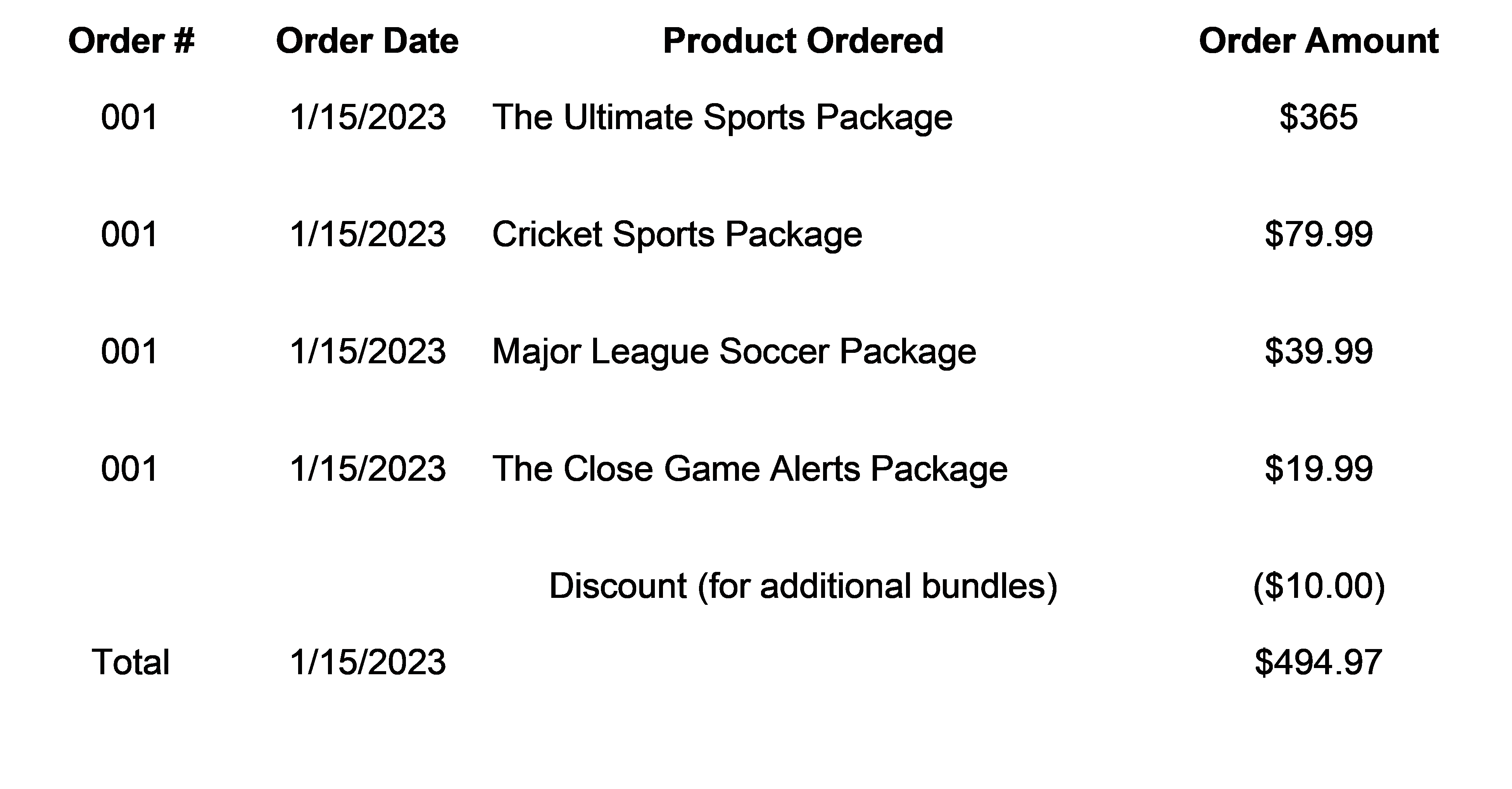

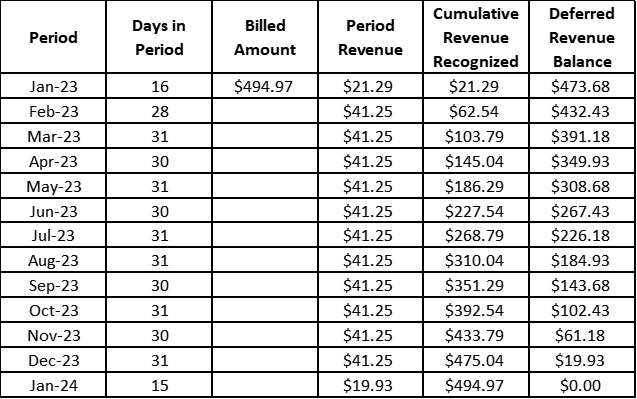

In this example, we assume the customer signed an annual agreement for our main subscription service, and three add-on bundles:

- The Ultimate Sports Package

- Cricket Sports Package

- Major League Soccer Package

- Close Game Alerts Package

This package at regular price would be $504.97, the total price for the customer would be $494.97 after the $10 discount. The customer ordered the package and paid for one year upfront. The service period starts on January 15th, 2023, and ends one year later on January 24th, 2024 For allocation purposes we prorate the $10 discount across all four products. The logic for using this method is it will best help us understand product line revenue because if we apply the full discount to the last two packages offered, it will understate those packages' revenue and margin while overstating the 1st two packages. In this example, the customer is invoiced upfront for the full amount, and the invoice is as follows:

For allocation purposes we would allocate revenue to the products as follows

- The Ultimate Sports Package - $357.77 or 29.81 a month

- Cricket Sports Package - $78.41 or $6.53 a month

- Major League Soccer Package - $39.20 or $3.27 a month

- Close Game Alerts Package - $19.59 or $1.63 a Month

The total monthly amount billed will be $41.25.

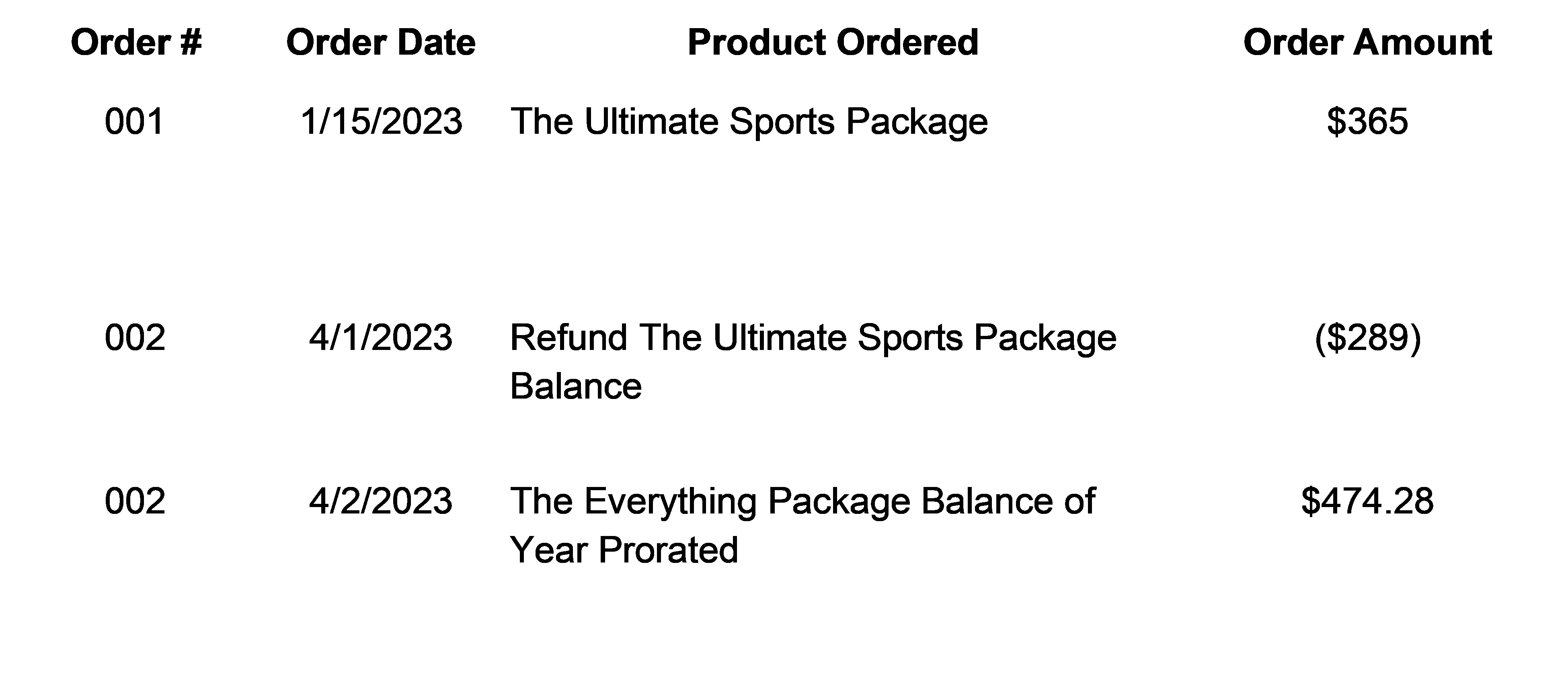

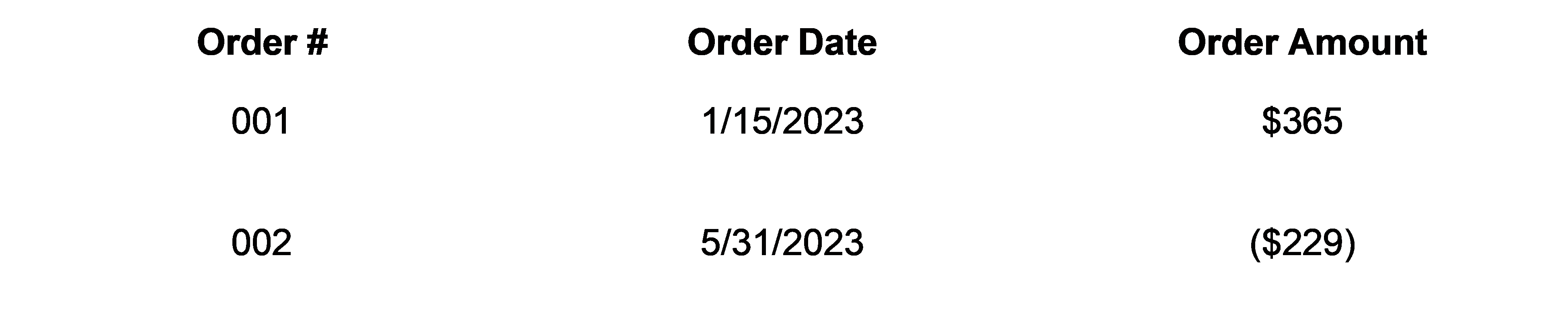

Product Upgrades

In this example we assume the customer signed up for the product on January 15th, 2023. and started receiving services the same day. At the time of customer sign up the customer was billed $365 for a one-year subscription through January 14th, 2024.

On April 1st, the customer upgraded from The Ultimate Sports Package to The Everything Package.

For this example, the schedules would look as follows:

Product Downgrades

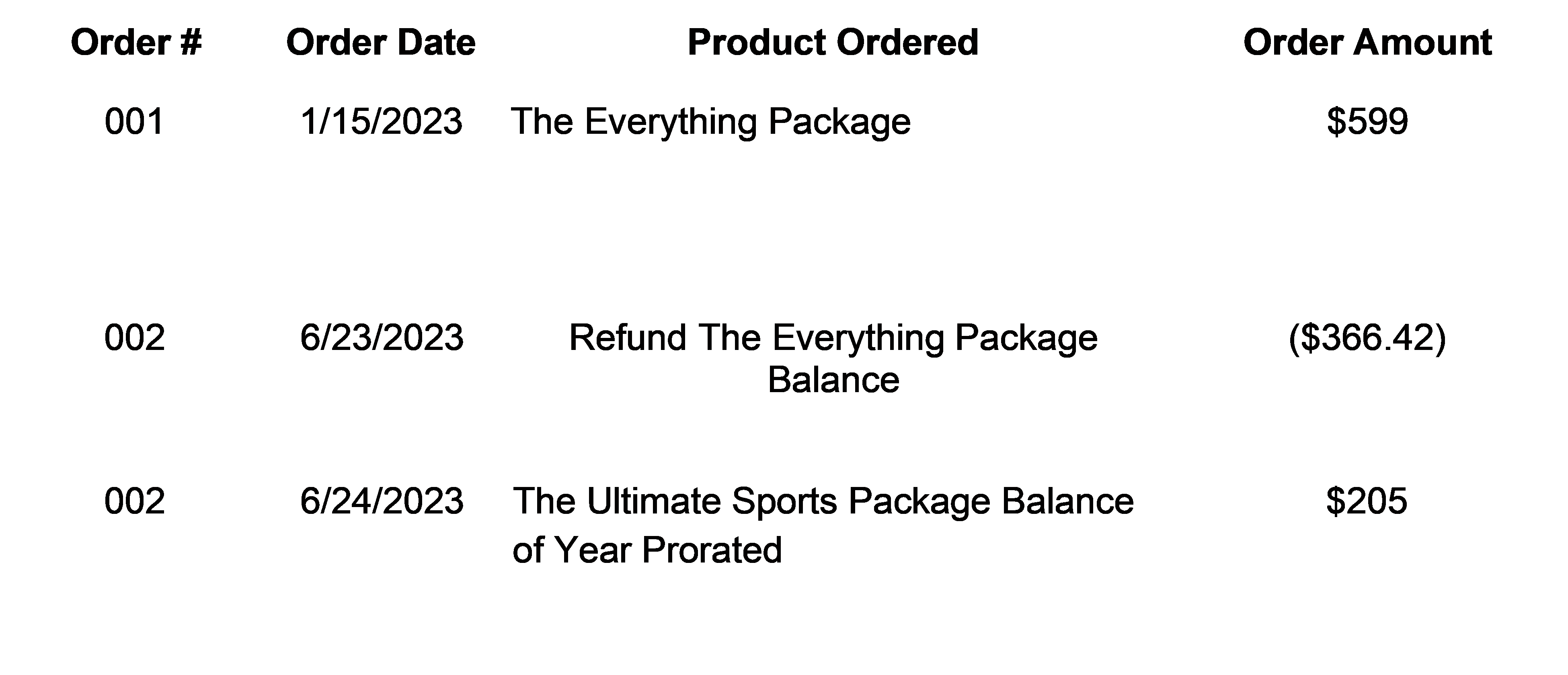

For this example let’s assume the customer signed up for The Ultimate Sports Package on January 15th, 2023 and started receiving services the same day. At the time of customer sign up the customer was billed $599 for a one-year subscription through January 14th, 2024.

On June 23rd, the customer upgraded from The Ultimate Sports Package to the Everything Package.

For this example the schedules would look as follows:

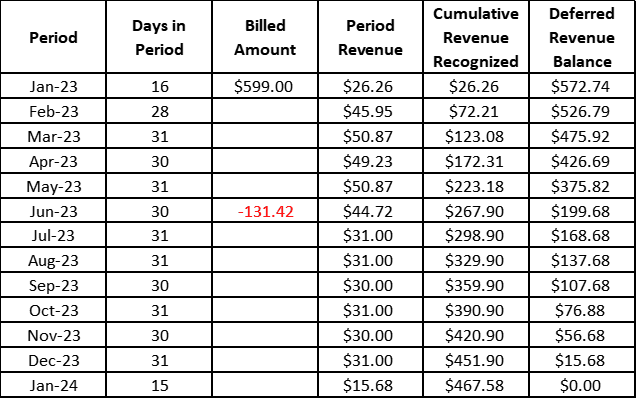

Product Refunds

When it comes to refunds two examples exist. The first is a cancellation with a refund and the second is a cancellation without a refund. For these two examples let’s assume the customer orders The Ultimate Sports Package on January 15th, 2023, and cancels the package on May 31, 2023. In the first scenario, they are eligible for a refund and in the second scenario no refund is received when they cancel the product

Scenario 1 - Revenue Recognition for Cancellation with Refund

Revenue Schedule

Scenario 2 - Revenue Recognition for Cancellation without Refund

Revenue Schedule

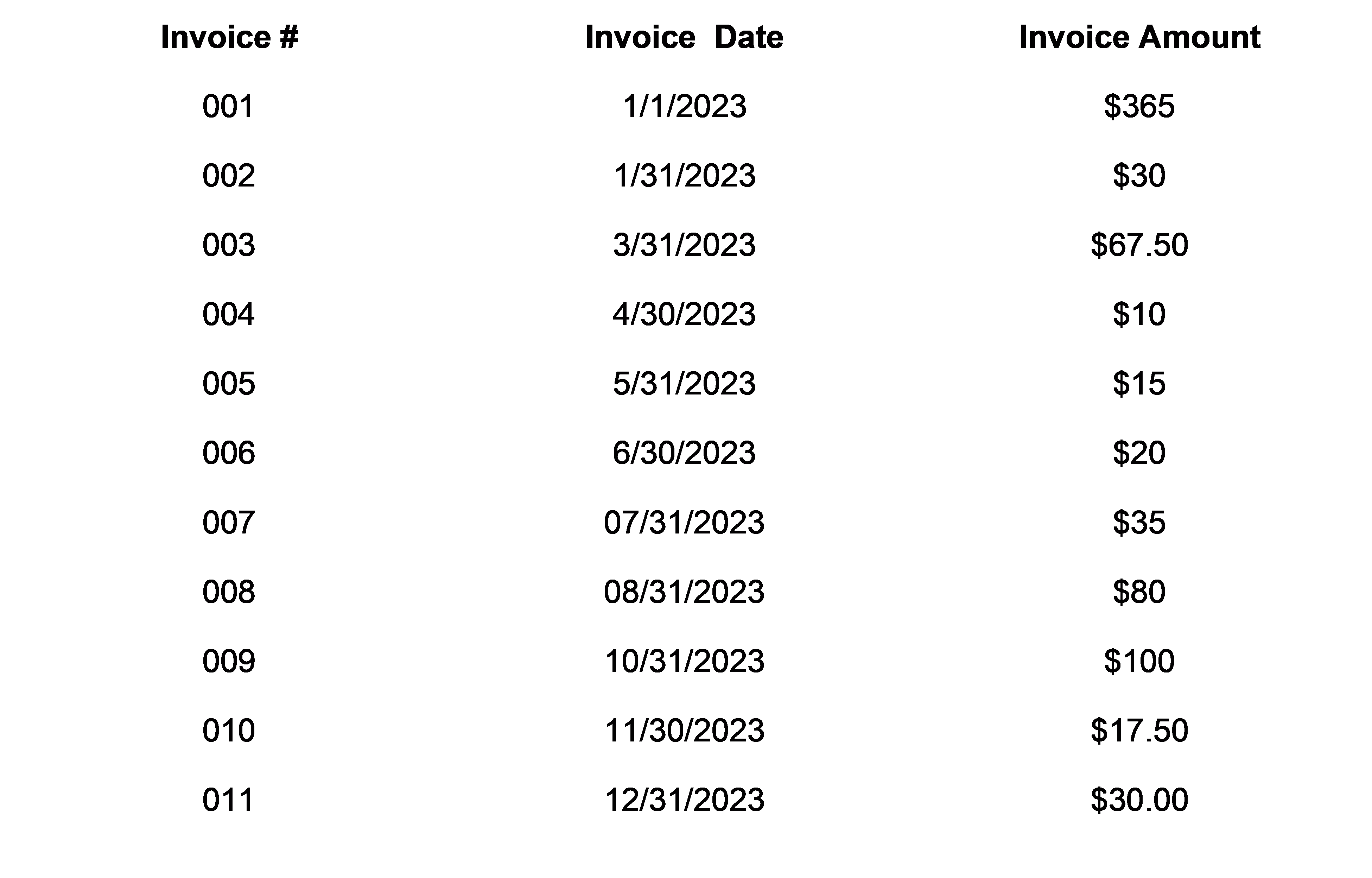

Product Usage

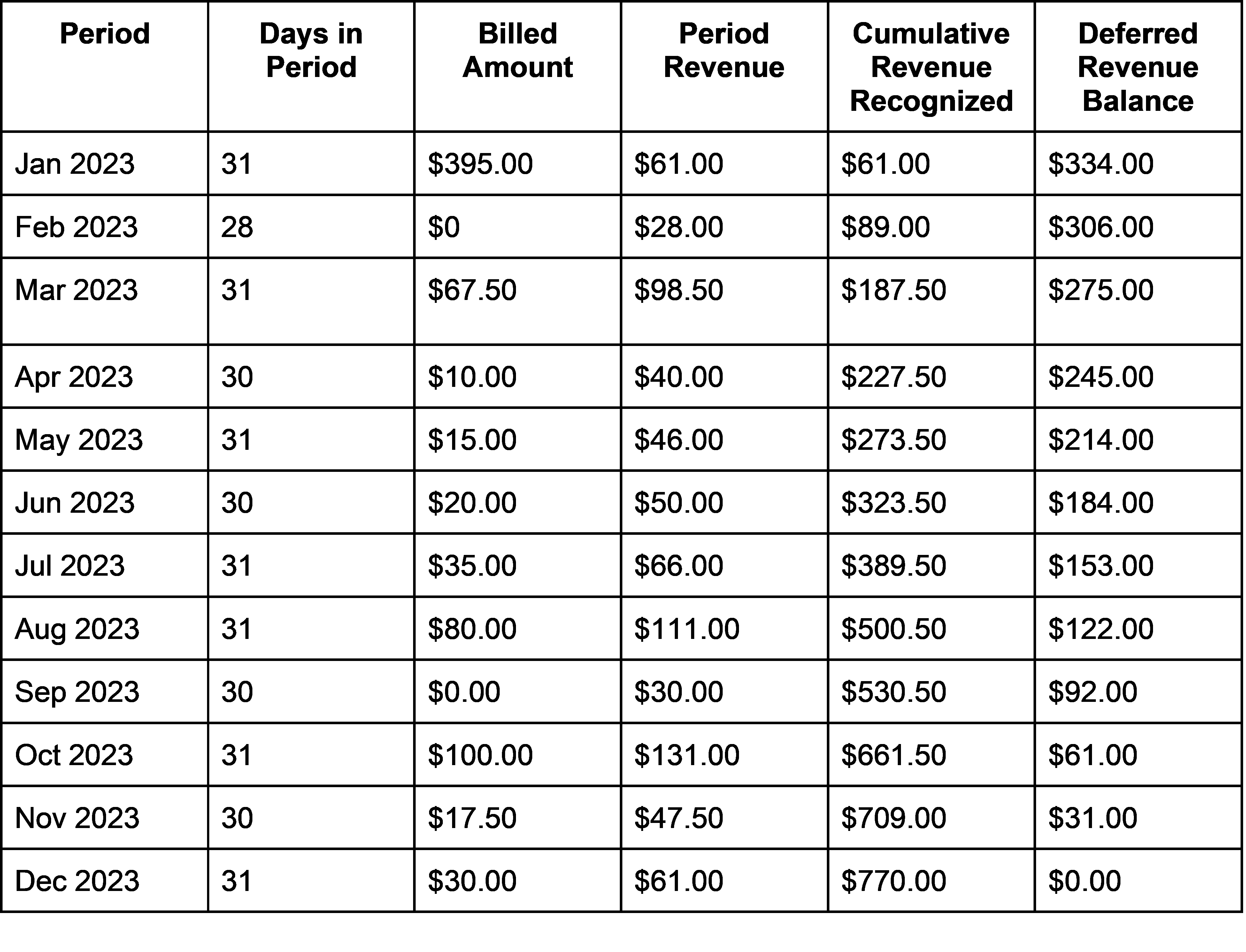

Sports Entertainment has decided to offer an optional product that is billed based on product usage. The product is the ability to watch any sports game from the prior ten seasons. The fee is $2.50 for every game watched from a prior season and is billed on the last day of each month. Our customer buys the standard package on January 1st, 2023 for $365.00 and then has the following usage pattern for 2023.

Usage Pattern

- Jan 2023 - 12 Games

- Feb 2023 - 0 Games

- March 2023 - 27 Games

- April - 4 Games

- May - 6 Games

- June - 8 Games

- July - 14 Games

- August - 32 Games

- September - 0 Games

- October - 40 Games

- November - 7 Games

- December - 12 Games

Revenue Schedule

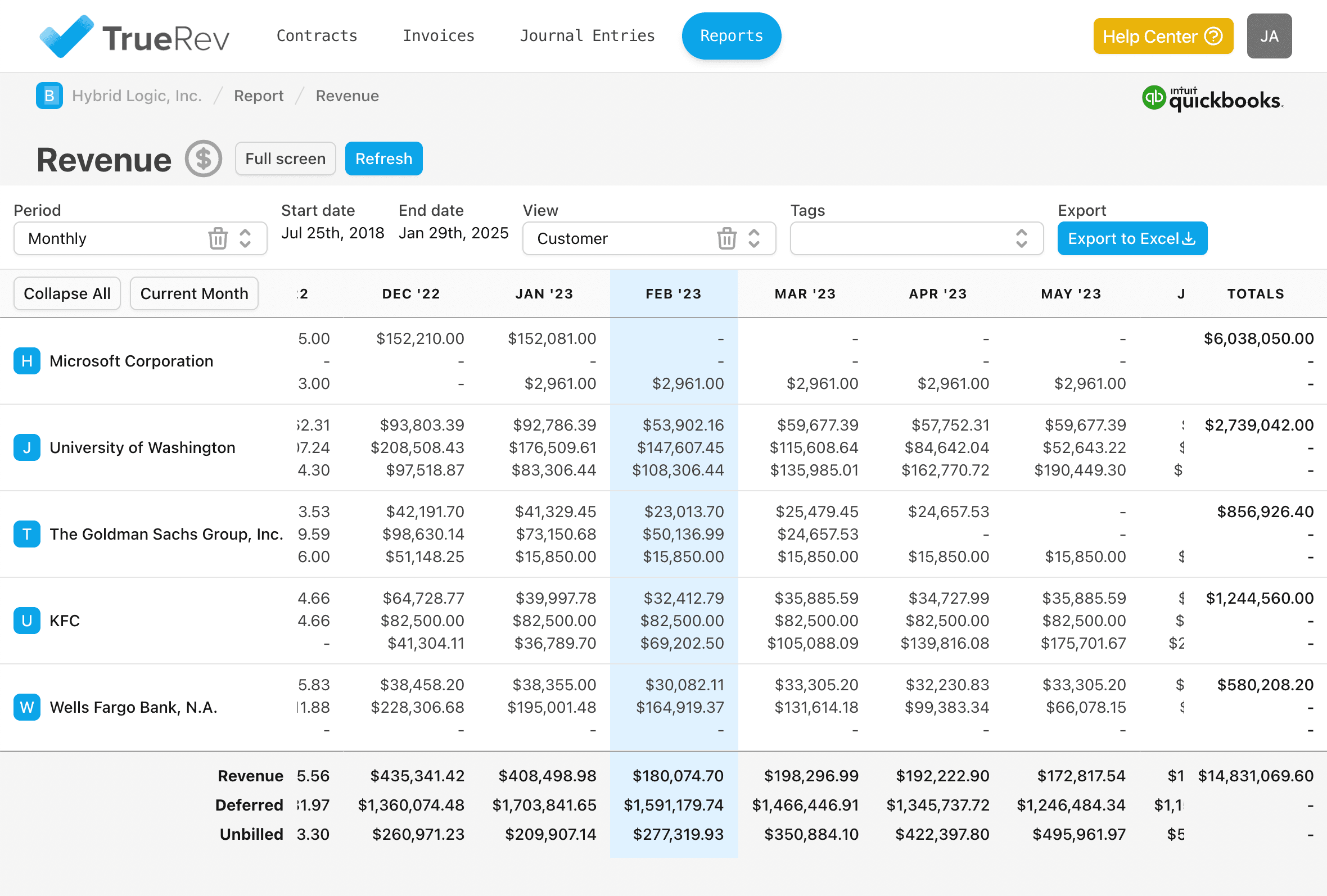

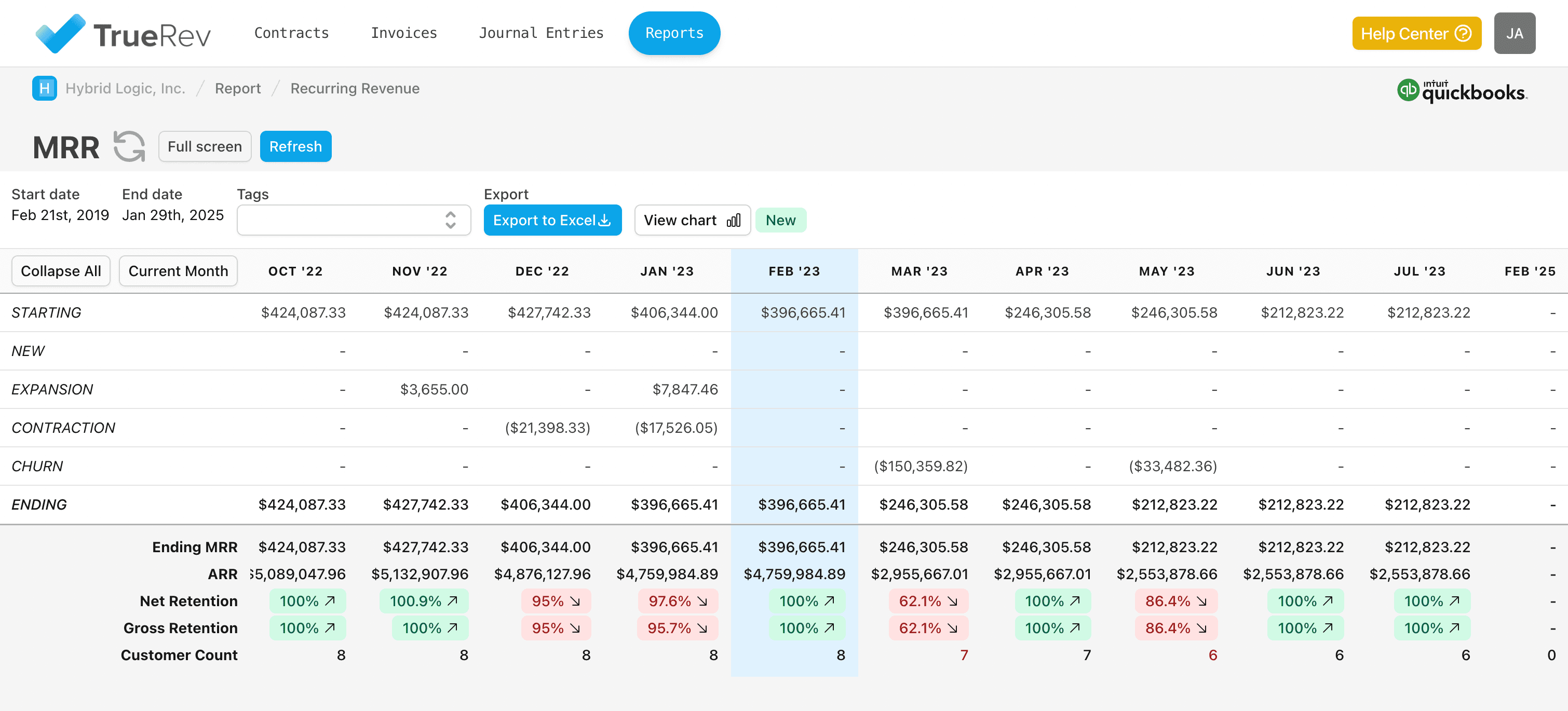

Managing Deferred Revenue

Each of the above examples shows what you would invoice the customer and how you would recognize the deferred revenue throughout the year. Building each example required building a 12-month schedule with multiple assumptions. Imagine if you had to build the schedule for 100’s or even 1000’s of customers all with different start dates and packages. This is what subscription-based businesses have to do every day. Many companies manage the deferred revenue schedules each month in excel. However, as the number of customers and product offerings grow it becomes more and more difficult to manage deferred revenue schedules in Excel. This is where tools such as TrueRev come in handy as they manage the process for you. TrueRev manages your:

- Revenue Schedules and ensures compliance with ASC 606

- Subscription Metrics by building them in minutes within the tool

- Contract Events - upgrades, downgrades, expansion, etc

To learn more about TrueRev and how they can manage your Revenue click here. Visit TrueRev

Final Thoughts

The subscription business model is a very attractive business model because it allows you to earn revenue that acts like an annuity and as long as you can keep the customer you continue to earn revenue every month. Furthermore, many customers pay you the revenue upfront which helps you manage cash in addition to having a perpetual revenue stream. With this attractive revenue model comes some challenges in managing the revenue recognition in such a way that it complies with 606.

The 5-step framework used to guide your revenue recognition is described below:

If you follow this framework and develop a plan for ensuring you recognize revenue for all the different scenarios your business might face you will be in a position to ensure your revenue is recognized correctly and to build the revenue metrics needed to understand your business.

Want to see a demo?

we offer a 14-day free trial.