Ali Rizvi

Article What is Customer Lifetime Value and How Do You Improve It?

To understand the value every customer brings to your business, you should be aware of the metric called Customer Lifetime Value.

The simple reality is: you must focus on what drives sales to your business —and those are your customers.

An increase in ARR will come from people who buy products or services that provide value to them.

Putting your customers at the center of your business changes the view of your marketing strategy.

You go from selling to mere buyers to engaging a customer base of dedicated and loyal fans. All of which are made possible when customers feel valued.

What is Customer Lifetime Value?

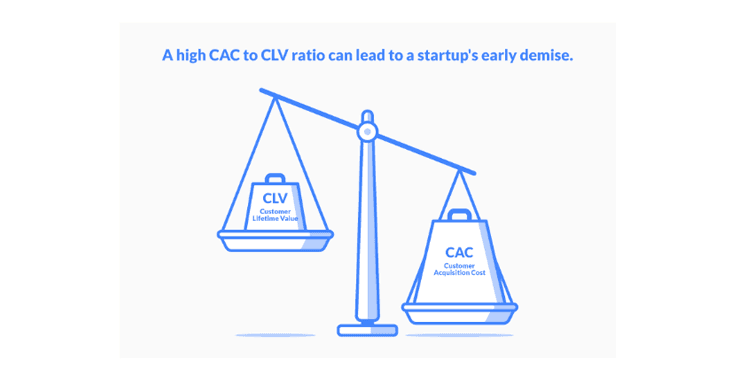

Customer Lifetime Value (CLTV) or (CLV) measures the value a customer brings to your business during their lifetime of using your product or service.

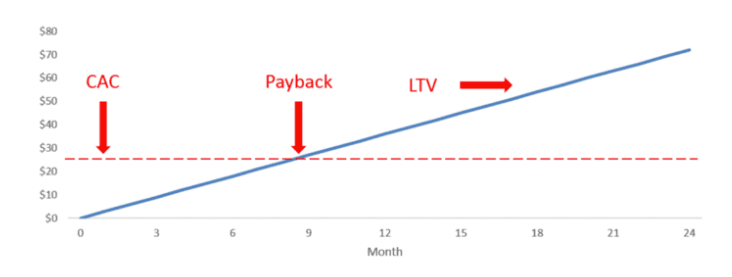

This metric considers an estimated value of the customers’ revenue during the “paid use” of a product or service and compares it with the cost of acquiring that customer during the customer’s lifespan.

A good CLTV follows a model where the cost of customer acquisition is relatively low.

Image credit: Redwhale

Image credit: Redwhale

For early and growth-stage companies, tracking your CLTV can help determine the success of that company.

Why you may ask?

For starters, the goal behind measuring a customers’ value to a business is with an eye towards customer retention.

In a study by Harvard Business Review, researchers found that acquiring a new customer is anywhere from 5 to 25 times more expensive than retaining a new one.

It goes even further in the research done by Frederick Reichheld of Bain & Company: “Prescription for Cutting Costs”. In this research, he discovered that even across a wide range of businesses with different models, each additional year a customer stays can generate a large increase in the bottom line profits.

An increase in the profits and revenue of companies like these is a result of the proper measurement of various metrics including CLTV.

But what are these metrics, and how do you calculate them?

How to calculate your Customer Lifetime Value

The concept of calculating your customer lifetime value is highly dependent on the business model you’re running. In a practical sense, a business model based on a one-time purchase can’t measure their CLTV like a subscription-based business model.

However, a unified process for measuring your CLTV can be based on how much revenue each customer adds to the business.

Using each customer’s lifetime additional revenue to the business allows you to take into account your CAC (Cost of Customer Acquisition).

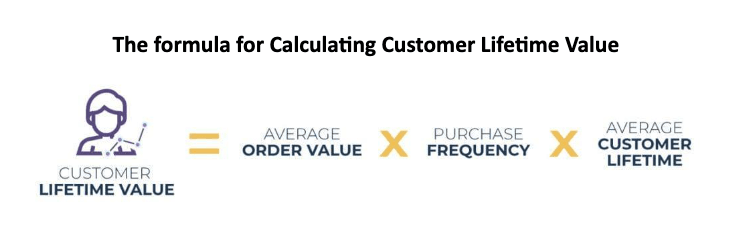

In simpler terms, you can calculate your CLTV by multiplying your customers’ average order value by their purchase frequency, and average lifetime.

Image credit: Zaius

Image credit: Zaius

This is the most basic formula you need to get going in calculating your CLTV —but let’s take a pause and discuss the basics of each metric and how they contribute to producing an estimate of a customers’ LTV.

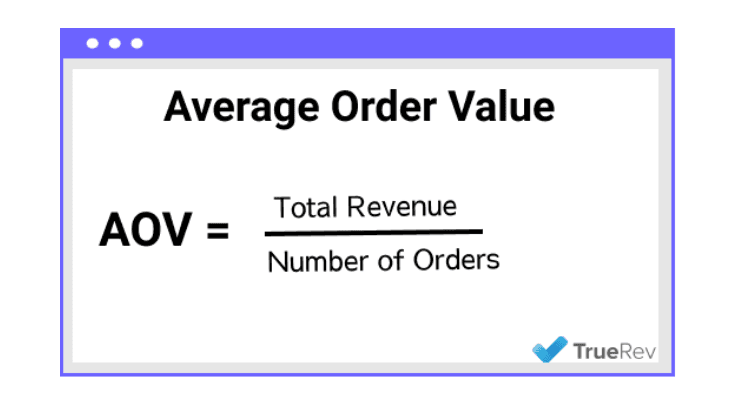

Average Order Value (AOV)

The average order value (AOV) or sometimes called “Average Purchase Value” (APV) is the average amount spent each time a customer places an order for a product or service.

In calculating your AOV, you need to divide your revenue by the total number of orders placed.

Practical example:

Let’s say CRM software makers SalesForce had 200 new customers in June, with total new revenue of $2,000,000 for the month.

Practical example:

Let’s say CRM software makers SalesForce had 200 new customers in June, with total new revenue of $2,000,000 for the month.

Your AOV on those new orders will be $2,000,000 (revenue) divided by 200 (number of orders) = $10,000

This puts your AOV for the month at $10,000.

Why your AOV Matters

From a sales standpoint, the goal is to get as many customers as possible but without spending excessively to acquire them. Sales and marketing spend need to be optimized to winning new customers that will payback that spend as quickly as possible. While this sounds simple, in reality it is not. The first step to understanding is to be able to measure consistently over time, and using that knowledge to shape customer acquisition and pricing strategy at your company.

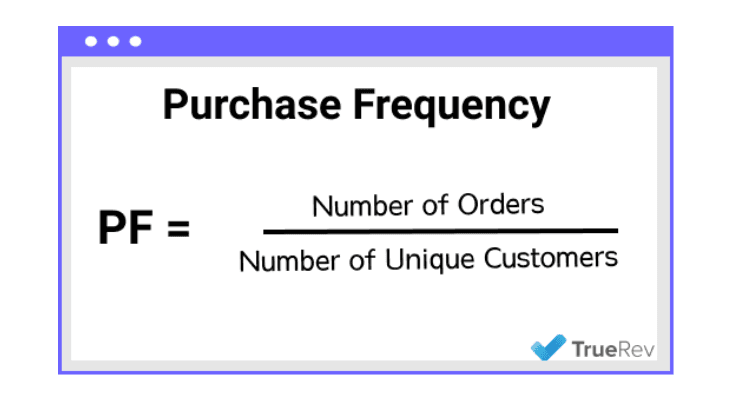

Purchase Frequency (PF)

This refers to the average number of purchases made by each customer with a single seller within a period of time.

Or you can define it as measuring how often a customer purchases a product or service from a business over a period of time. For many B2B SaaS businesses with annual subscriptions, the purchase frequency is relatively straightforward; once/year.

In utilizing the PF formula, you should consider the time frame you intend on calculating.

Typically, one year is recommended for getting the best PF results as it gives you time to understand customers buying behaviors all across different periods of the year.

In utilizing the PF formula, you should consider the time frame you intend on calculating.

Typically, one year is recommended for getting the best PF results as it gives you time to understand customers buying behaviors all across different periods of the year.

Nonetheless, you can still calculate your PF quarterly using the same formula.

Furthermore, it’s required you include “unique customers” when you calculate your PF to avoid measuring duplicate purchases.

Practical example:

Take for instance from January of 2022 to December 2022, you had 580 unique purchases and a total of 300 customers.

Your purchase frequency will be 580 (the number of purchases) divided by 300 (number of customers) = 1.9.

This puts your 2022 PF at 1.9.

Why your PF matters

The fundamental ground on which PF is built is to utilize customer behavior as a benchmark in influencing repeat purchases for a business. These behaviors result in tailored marketing campaigns for such customers for repeat purchases to happen.

A classic example of such a campaign is a win-back email campaign to customers who haven’t purchased in a while.

With campaigns like these, the chances of repeat purchases become higher as you have a 60-70% probability of making a sale from an already existing customer compared to a 5-20% on a new one.

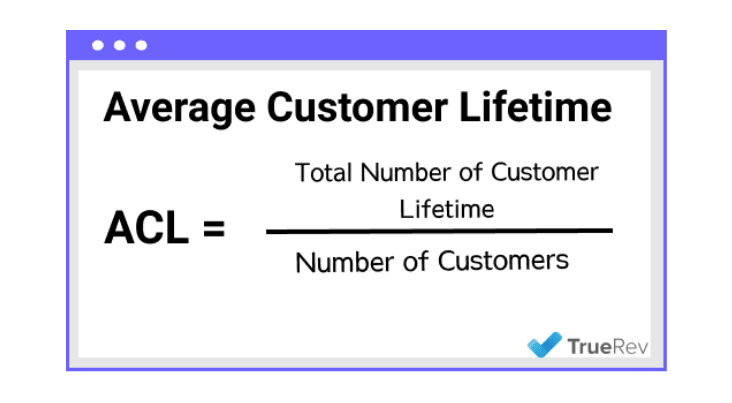

Average Customer Lifetime (ACL)

Average Customer Lifetime refers to the average number of years that a customer continues purchasing a business’s products or services. In general, the stickier the product, the longer the ACL. For many start-ups, this often begins as an estimate and is refined over time.

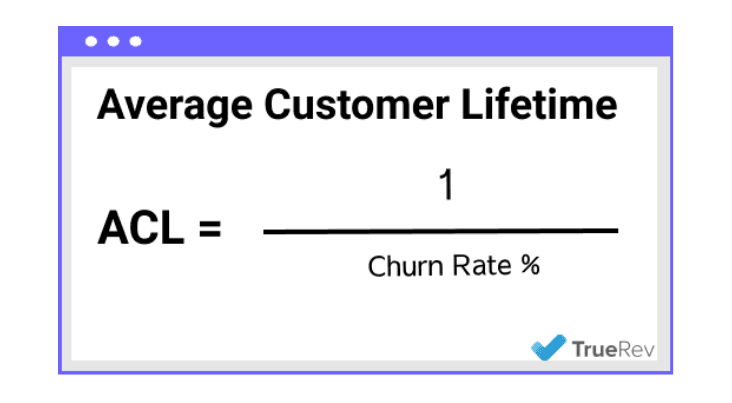

A PM at Hubspot wrote about a better way for measuring your ACL especially if you are in a subscription business, which is to divide 1 by your churn rate.

A PM at Hubspot wrote about a better way for measuring your ACL especially if you are in a subscription business, which is to divide 1 by your churn rate.

When you’re running this type of business model, there’s a need to track your churn rate in relation to arriving at your ACL.

When you’re running this type of business model, there’s a need to track your churn rate in relation to arriving at your ACL.

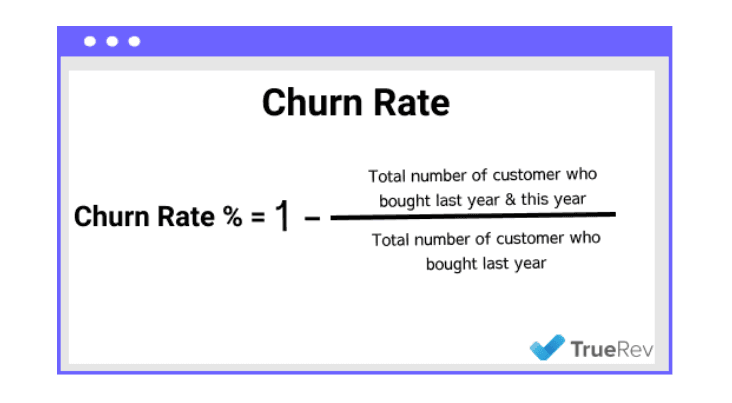

A simple way to calculate your churn rate according to Remen is to “track how many customers purchased in two sequential periods and divide that by the total number of customers who bought in the first period.”

Comparing two periods can be measured monthly, annually, or quarterly preferably —it depends on what you want to achieve.

To calculate your annual churn rate, for example, you can use this formula:

Image credit: Dan Olsen

Image credit: Dan Olsen

- Your AOV allows you to know the amount spent each time a customer places an order for your product or service.

- Your PF gives you an estimate of how much a customer is loyal to you based on how frequently they purchase from you.

- Your ACL gives you an overview of how long your customers will keep returning.

All these put together, are what produce the estimated value a customer brings to a business over the time spent purchasing your product or services—which is the Customer Lifetime Value. How to get an increase in revenue with less acquisition cost?

A rule of thumb for your CLTV to CAC ratio is 3:1.

Image credit: Propeller CRM

Image credit: Propeller CRM

And never beyond that!

Your CLTV helps identify how to understand buying patterns and behaviors of your customers to eliminate unnecessary marketing spend.

With that, you’re able to optimize your marketing budget on customers who already trust you. Even better, a study by Hoovers further proves that a 5% increase in customer retention can boost profitability by 75%.

Based on this, the goal should be to reduce the spending on acquiring new customers, and instead focus on retaining existing ones.

How to Improve Your Customer Lifetime Value

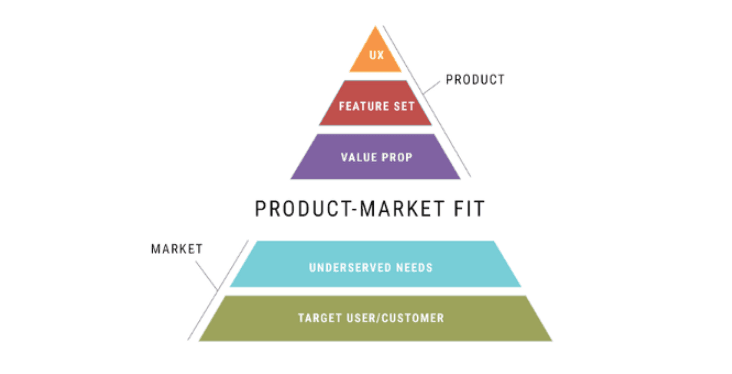

Customer buying patterns are shifting, and especially in B2B SaaS, where prospective customers want to test out the product before buying it. Selling to and securing every customer takes effort from the marketing, sales, and customer success teams, and of course the product has to be great. Let’s look at a few areas that have an impact on CLTV.

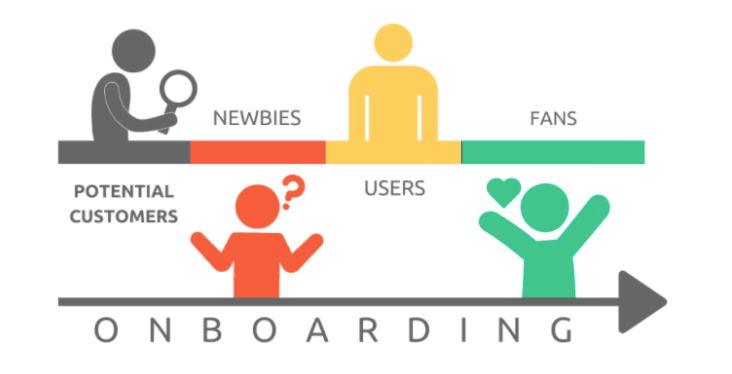

1. The Customer Onboarding Experience

First impression matters and onboarding customers for the first time is critical to engagement. If you do it well, they stay, —and if you do it badly, they leave.

In Wyzowl’s industry report on businesses onboarding experiences, they discovered that onboarding is critical.

Nearly two-thirds (63%) of customers say that onboarding – the level of support they’re likely to receive post-sale – is an important consideration in whether they make the decision in the first place.

The report even goes further to show that “86% of people say they’d be more likely to stay loyal to a business that invests in onboarding content that welcomes and educates them after they’ve bought.”

To avoid potential churn early on, you need to make your onboarding experience as easy as possible and consistently repeatable with every customer.

An intuitive and detailed breakdown of how your product or services work is a huge game-changer especially when you move potential customers to big-time fans.

Image credit: Custify

Image credit: Custify

It tells the customer that you’re dedicated to solving their problems or help them get their desired results.

2. Build Relationships Through Active Customer Communications

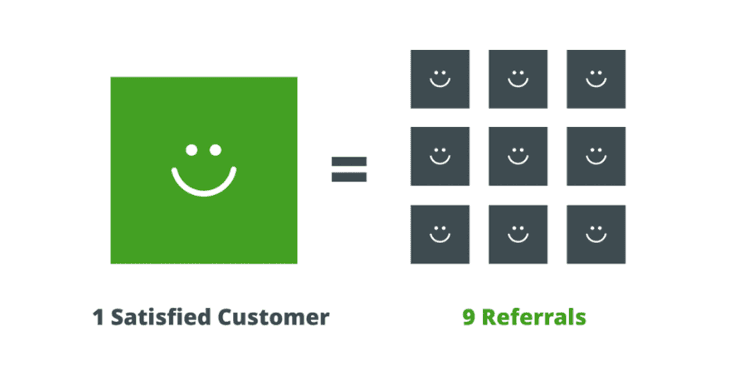

Successful companies have a good line of communication between the company and their customers. It’s no wonder that 89% of customers are more likely to make another purchase after a good customer service experience.

For a moment imagine 89% of your customers returning to you simply because they’re able to communicate with your business. And no, not automated responses, rather, an active human correspondent that gives the company life.

It is hard to accurately quantify ROI of good customer service, but can have an outsized influence on CLTV.

Plus the probability of new customer referrals increases drastically.

Image credit: Live & Learn Consultancy

Image credit: Live & Learn Consultancy

Referrals like these are a bi-product of good customer service, giving you better ROI than many more expensive marketing programs you may have in place.

In conclusion,

The best way to drive long term success for your business is by understanding and harnessing important metrics like CLTV. However, getting those metrics shouldn’t take you days when you can get them in minutes.

Be honest… can your B2B SaaS team reliably keep up with and track your most important financial metrics? Is MRR/ARR the only metric you track?

Do you trust the metrics you track to be 100% accurate?

Whatever the answer, you’re not alone —and yeah it can be quite exhausting trying to optimize every single metric out there. One minute you’re measuring your customer acquisition cost, —and in another, you’re keeping track of your churn rate.

With TrueRev, you can skip the hassle of manually computing important metrics like recurring revenue (MRR/ARR), churn, retention, and cash flows from your customers.

The best part, you can try TrueRev for free —no credit card required.

Want to see a demo?

we offer a 14-day free trial.